Core concepts

HyperRAM

HyperRAM = hyper-efficient DEX + x(3,3) + HyperEVM native integration.

The vision for Ramses is simple: build the most efficient exchange possible, then distribute 100% of the value entirely to participants with the x(3,3) model. With significant portions of the initial supply dedicated to the community through RXP points and other rewards programs, Ramses prioritizes community-first development and sustainable value creation.

Hyper-efficient

Maximum value capture, zero leakage. DEXs lose millions to MEV bots and inefficient fees; we built sophisticated MEV infrastructure with dynamic fees that respond to real-time market conditions and privileged MEV pipelines that capture every opportunity. Every dollar captured flows is distributed to users through the fair incentive model x(3,3).

| Feature | Description |

|---|---|

| LP Protection | Dynamic fees and MEV prevent value leakage and protect LPs from toxic flow |

| Revenue generation | CEX-DEX, cross-venue (lending), HyperCore ↔ HyperEVM arbitrage |

| Cheap transactions | Compiler upgrade (solc 0.8 + viaIR) = ~2x gas efficiency |

| Privileged arbitrage | Atomic zero-fee swaps through privileged infrastructure |

| Complex strategies | Complex strategies leveraging oracle and market inefficiencies |

| Cross-venue arbitrage | HyperCore, Ethereum, Arbitrum, Aave, DeFi protocols |

HyperCore integration allows for CEX like arbitrage—atomic execution between Hyperliquid spot markets and Ramses means we capture value before external bots have a chance. Our privileged infrastructure enables instant fee adjustments and zero-slippage arbitrage.

True efficiency means zero value leakage, not just from MEV bots, but from vulnerabilities and exploits. $2M+ spent on security across audits, contests, and bounties ensures our infrastructure operates without risk.

HyperEVM Native Integration

On HyperEVM, protocol revenue is used to buyback HYPE from the market. Stakers automatically earn HYPE from every trade, fee, and vote incentive on the platform—providing predictable, spendable rewards for users. Unlike traditional metaDEX models, rewards are denominated in the same HYPE that powers trading on HyperEVM, ensuring incentives stay aligned and value remains anchored in the ecosystem's core markets.

Ramses prioritizes community-first development and sustainable value creation. With 30% of initial supply dedicated to the community (RXP points + Community incentives), we prioritize community alignment, rewarding those who contribute and align with the protocol's long-term success.

x(3,3)

x(3,3) a fairer and more accessible version of ve(3,3) which maintains user alignment with value creation rather than forced lock-ups. To understand how x(3,3) works, we need to first understand ve(3,3):

ve(3,3)

The Solidly model, introduced by Andre Cronje, brought together two key concepts:

Vote Escrow (ve)

Curve's 2020 innovation that introduced time-weighted voting. Instead of voting with token amount a, tokens are lockable in a VotingEscrow (veA) for a selectable locktime, creating a risk vs. reward scenario where longer locks grant more governance power.

Rebase

An anti-dilution mechanic inspired by OHM (3,3) where locked positions rebase to maintain ownership share as emissions are distributed, allowing veTOKEN holders to maintain the same ownership without buying and locking more tokens.

Modern implementations have proven ve(3,3) can achieve massive scale, but they rely on artificial restrictions: forced lock-ups create high friction and unfair access to rewards. Users must make upfront commitments to participate equitably, creating a system driven by obligation rather than ongoing value.

ve(3,3) → x(3,3)

ve(3,3) has a fundamental design flaw: it relies on static commitment rather than dynamic value creation. Even the most successful ve(3,3) exchanges still require users to make upfront commitments to earn meaningful rewards, creating a system where participation is driven by obligation rather than ongoing value. x(3,3) flips this entirely—it rewards users based on their active contribution to protocol success, with exit flexibility that ensures only those who genuinely value the protocol remain engaged. This creates a self-selecting community of active participants rather than passive token holders who do not participate.

Without an exit measure, the system accumulates dead voting power, as users hold veTOKENs indefinitely without active participation, still influencing the protocol without contributing to its success.

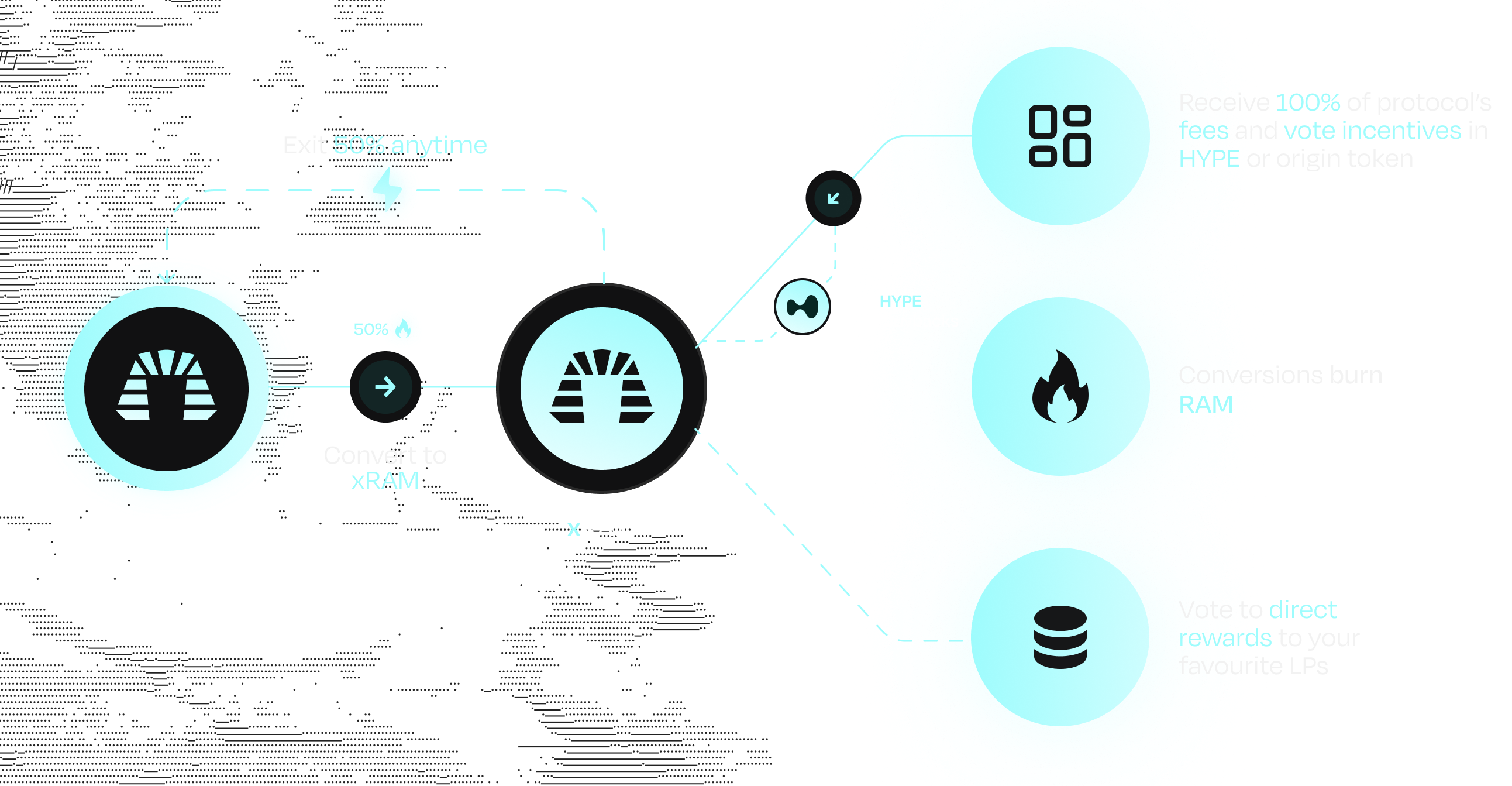

Burns

This shift from static to dynamic participation requires a fundamentally different approach to dilution protection. Instead of minting new tokens to locked positions, x(3,3) introduces a burn mechanism—a deflationary system that protects remaining holders while enabling flexible participation (50% burn when RAM → xRAM, exit anytime).

This creates a self-reinforcing cycle: as users exit xRAM, the remaining holders benefit from reduced supply through burns, those who stay are rewarded with a higher value per token.

- Deflation scales with the protocol (user activity)

- Strong incentive to stay instead of lock-ups

- Removes the need for locks or wrappers

- xRAM solves the need for token lock-ups

- hyperRAM (Liquid staked xRAM) solves the need for liquid wrappers

Burn vs Rebase

In a model where conversions happen often, burning is more efficient than rebasing:

| Feature | Burn Model (xRAM) | Rebase Model (Traditional ve(3,3)) |

|---|---|---|

| Supply Impact | Permanently removes tokens from circulation | Maintains total supply, redistributes ownership |

| Deflationary Pressure | Continuous deflationary pressure from exits | No deflationary pressure, inflationary emissions |

| APR vs Value | Lower APR, but higher token value over time | Higher APR, but diluted by emissions |

| Exit Economics | Each exit contributes to deflationary economics | Exits don't affect overall supply dynamics |

| Innovation | First deflationary ve(3,3) protocol | Traditional inflationary model |

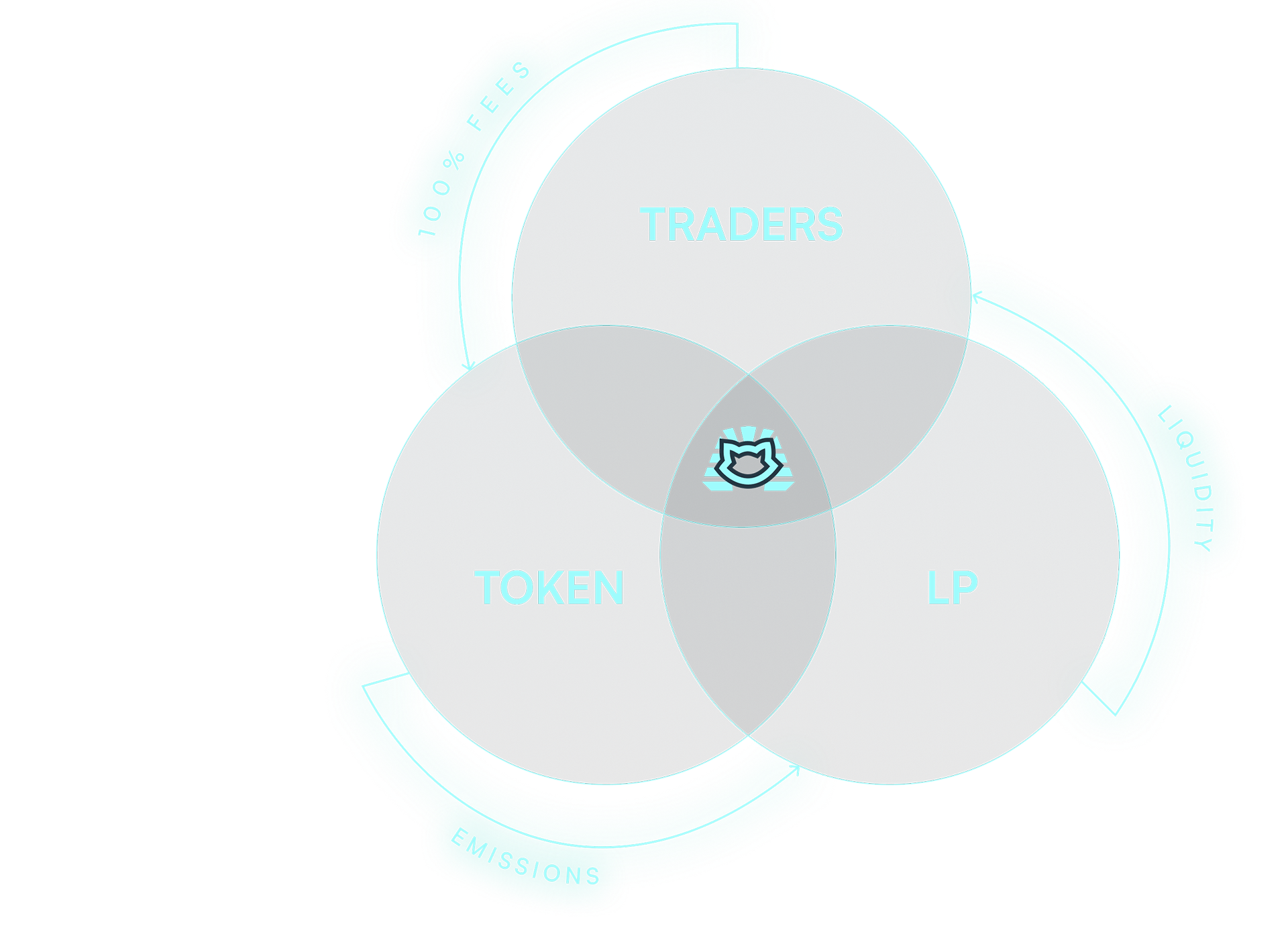

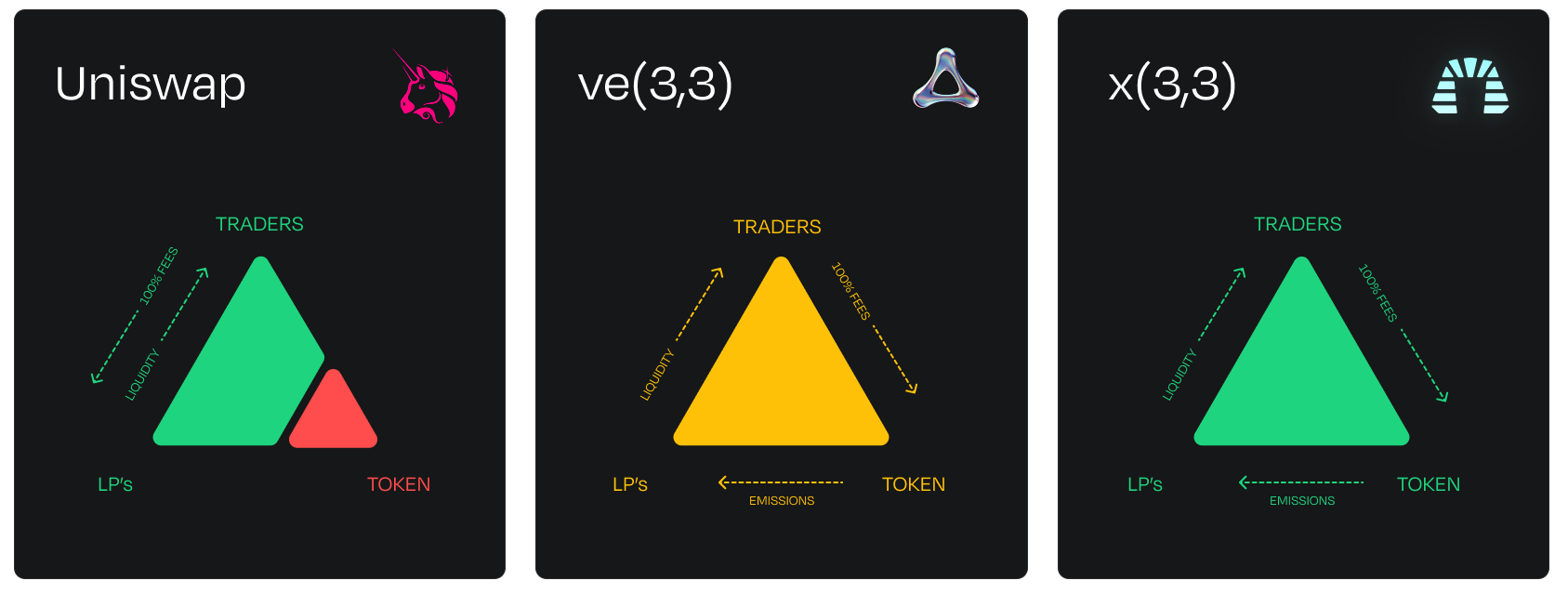

Trilemma

The history of decentralized finance has been marked by repeated attempts to solve the "DEX Trilemma" - the challenge of aligning incentives between traders, liquidity providers, and token holders. While the ve(3,3) model theoretically solved this by balancing incentives between all participants, long lock-ups created a high friction system that forced users to lock tokens to participate equitably in the incentive model.

Credit to the Aerodrome team for the original graphic and concept.

Uniswap focused on a simple two-party system: traders and liquidity providers (LPs). ve(3,3) improved this by properly aligning incentives with token holders as well, but access to those incentives was unfair and heavily skewed towards protocols.

| Uniswap | ve(3,3) | x(3,3) |

|---|---|---|

|

|

|

x(3,3) model

xRAM is where x(3,3) shines by creating an incentive system that responds to real user behavior. While ve(3,3) exchanges create value through artificial scarcity and forced commitments, x(3,3) instead generates value through genuine user activity and captured value. When xRAM is minted, the burned tokens protect remaining holders from dilution. This creates a dynamic system where ownership naturally concentrates among those who contribute most value.

| Traders | Liquidity Providers | xRAM Holders |

|---|---|---|

|

|

Exit Mechanism

Ramses implements a unique exit system that provides dilution protection while maintaining flexibility. When xRAM is minted, 50% of the underlying RAM is burned, permanently reducing circulating supply. Users can exit their position anytime to realize 50% of the underlying xRAM:

- No lock-ups required - Exit anytime

- Deflationary protection - Burns reduce supply for remaining holders

- Liquid alternative - hyperRAM provides instant liquidity through open market trading

The combination of xRAM (direct participation) and hyperRAM (liquid staking) removes the need for complex ve-token wrappers while maintaining strong alignment incentives.

The result? A more fluid and accessible system that provides strong incentives while removing the friction of ve-token models (token lock-ups).

Directing Emissions

As discussed in DEX Trilemma, prior to ve(3,3) users had no choice but to suffer from misaligned incentives from centralized parties. This led to inefficient capital allocation and reduced long-term sustainability for exchanges. x(3,3) solved this by putting emission control directly in the hands of xRAM stakers who are incentivized to optimize for value.

Directing emissions is an extremely powerful use case for xRAM stakers as it gives holders primary power over what the platform incentivizes. Combined with MEV revenue flowing to xRAM holders, this creates a feedback loop where voters are incentivized to direct emissions to the most productive liquidity: those pools that generate the most fees, trading volume, and arbitrage opportunities.

Less rewards from the pool = less emissions = less liquidity.

Each week, in what we call Epoch, xRAM stakers make a choice on what liquidity pools to direct RAM emissions to. Based on that vote which concludes every Thursday 00:00 UTC, RAM emissions are then directed to the chosen liquidity. You can read more about voting and how emission distribution is calculated here.

Voters earn swap fees and vote incentives in a lump sum immediately after epoch flip. These rewards are based on the liquidity you voted for in the previous epoch. If you vote for a liquidity pool in Epoch X, you will receive your accumulated rewards instantly when Epoch Y begins, proportional to your vote compared to the total votes.

Vote Incentives

On Ramses we utilize two different types of vote incentives: liquidity pool incentives & voter incentives. A vote incentive can be in the form of ANY whitelisted token. As a protocol, incentivizing your liquidity will attract voters and result in higher directed emissions. As an xRAM staker, you earn a portion of the incentives.

A voter incentive is designated at anytime during the current Epoch and paid out in lump sum to xRAM voters. It is displayed after the incentive is made and will influence votes until Epoch rollover.

A liquidity incentive is another method protocols can use to attract liquidity provision. This incentive is distributed directly to liquidity providers and is a great way to bootstrap new liquidity on the platform.

| Voter Incentives | Liquidity Incentives |

|---|---|

| Paid as lump sum at epoch start | Distributed over 7 days after epoch |

| Designated during current epoch | Used to boost pool visibility (direct yield) |

| Influences votes until epoch rollover | Helps bootstrap new tokens |

| Distribution | |

| To voters at epoch flip | To LPs for full week after epoch |

A vote incentive can be in the form of any whitelisted token, and must be applied to only active gauges. Be sure to read & understand voting before participating.

Fees

Ramses' x(3,3) model takes a straightforward approach to fee distribution:

- 100% to xRAM holders - All protocol fees flow to active governance participants

- MEV revenue - Arbitrage profits from privileged infrastructure also flow to xRAM holders

This creates a powerful flywheel where:

- High-performing pairs generate more fees and MEV opportunities

- xRAM stakers are incentivized to vote for productive liquidity

- Increased emissions attract deeper liquidity

- Deeper liquidity drives more volume, fees, and arbitrage opportunities

Fee-Split

Fees-splits can be configured per gauge, below are the default fee-splits for all liquidity types:

| With Gauge | No Gauge |

|---|---|

| 100% to xRAM | 0% to xRAM |

| 0% to Liquidity Providers | 95% to Liquidity Providers |

| 0% to Protocol | 5% to Protocol |

Each gauge can be configured with custom fee splits tailored to specific pool characteristics. This allows for optimized fee distribution based on pool type, volatility, and strategic importance to the protocol.

Dynamic Fees

Ramses' algorithm automatically adjusts fees based on market conditions and trading volume, providing maximal protection for liquidity providers while capturing the highest possible trading fees.

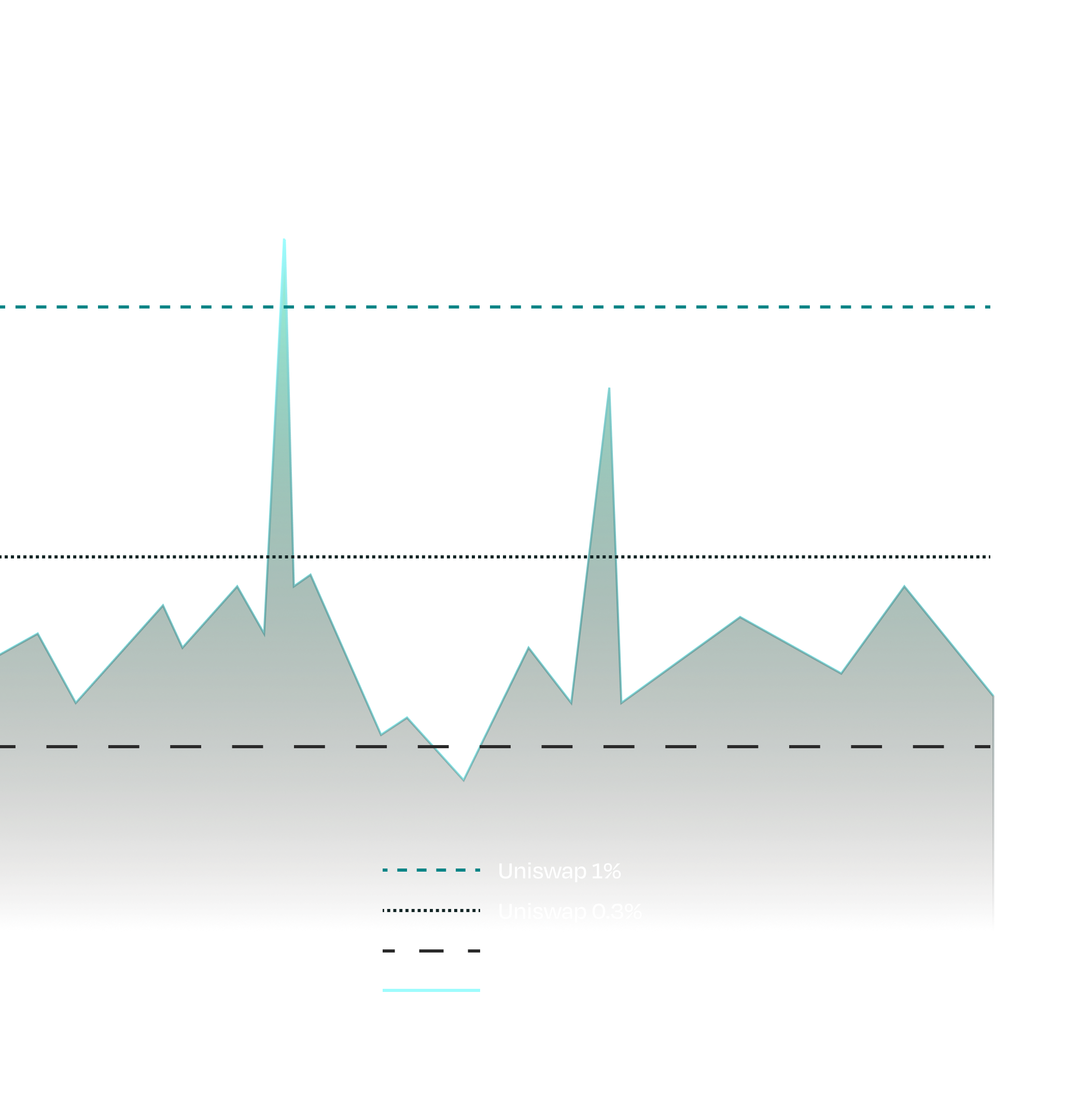

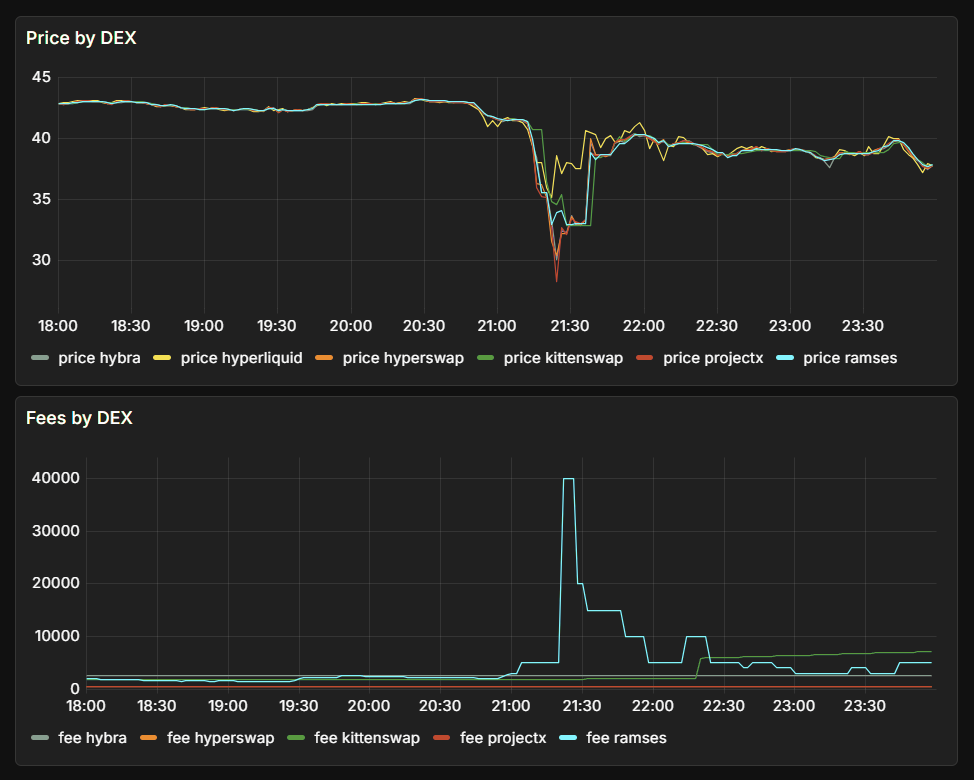

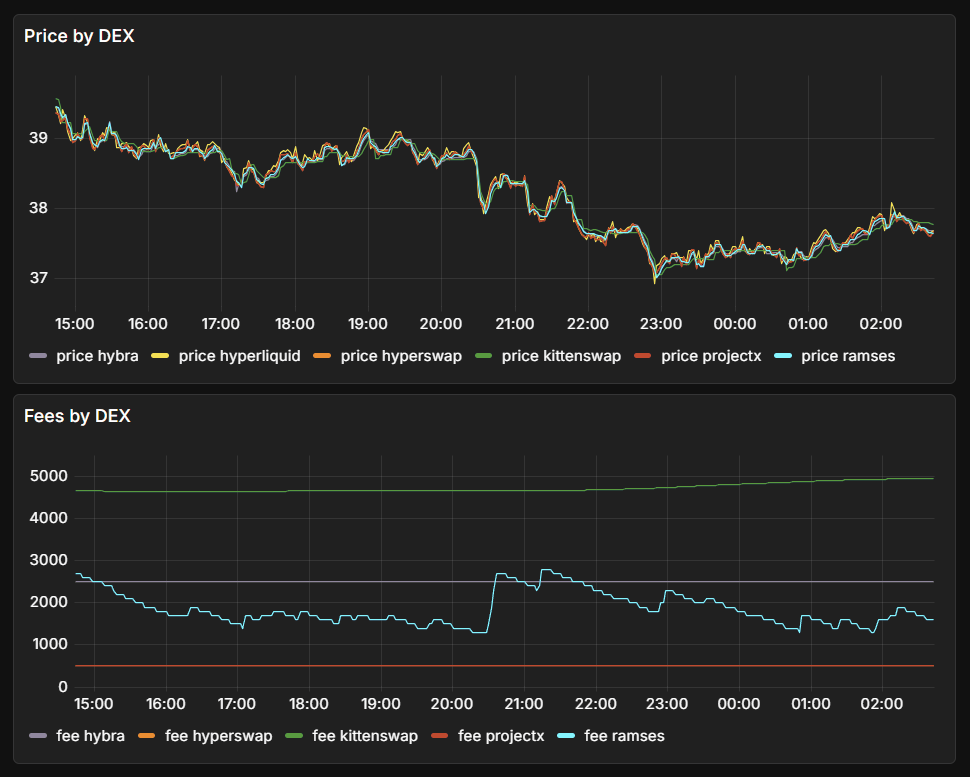

Below is a visual of Ramses' dynamic fees versus other exchanges:

While dynamic fee mechanisms are not entirely novel, Ramses' dynamic fee algorithm monitors both DEX and CEX volume inflow, including Hyperliquid spot markets. This comprehensive monitoring leads to better performance, higher fees, and reduced adverse selection costs. This is further enhanced by our MEV protection suite that captures arbitrage across HyperEVM, HyperCore, and crosschain. Learn more about our MEV protection mechanisms.

Real-Time Market Protection

Our algorithm is highly responsive, capable of adapting its parameters on sub-minute time scales. This rapid reactivity provides robust protection during periods of extreme volatility, as demonstrated during recent market crashes where the algorithm successfully ensured maximal protection of LP positions.

During volatile periods, the central objective is to shield LPs from excessive toxic flow while simultaneously capturing the highest possible trading fees. The algorithm continuously monitors:

- Relative liquidity distributions across venues

- Price deviations and typical trade sizes

- Real-time on-chain and market data

- Cross-venue volume patterns

During stable markets, the focus shifts toward maintaining a smooth trading experience and optimizing fee collection from non-toxic order flow. Since we continuously compete with other DEXs for volume, maintaining an optimal balance between fee level, liquidity depth, and spot price is crucial.

| Fee Range | Market Conditions |

|---|---|

| Base: 0.05% Cap: 1.00% | Normal market conditions, Stable trading pairs, High liquidity pools |

| Base: 0.30% Cap: 2.00% | Less liquid pairs, Higher volatility, Complex trading pairs |

| Up to 5.00% | Extreme market conditions, Flash crash protection, MEV resistance |

Our team continuously monitors and optimizes the algorithm, implementing specialized algorithms for different pool categories including volatiles, stables, LST (Liquid Staking Tokens), and meme pools, with novel approaches that account for trading patterns, redemption mechanics, liquidity cycles, and cross-protocol dynamics.

Big Blocks

HyperEVM uses a dual-block architecture that balances transaction speed and capacity. This design allows for both rapid confirmations and the handling of larger, more complex transactions.

| Block Type | Production Rate | Gas Limit | Use Case |

|---|---|---|---|

| Small Blocks | Every 1 second | 2 million gas | Quick, lightweight transactions |

| Big Blocks | Every 1 minute | 30 million gas | Complex operations & large contracts |

Small blocks are ideal for simple swaps, standard token transfers, and quick transactions that require fast confirmations. Big blocks accommodate complex operations like deploying large smart contracts, adding liquidity to concentrated liquidity positions, and transactions that exceed the small block gas limit.

Big-Blocks Auto-Switch

Ramses automatically toggles between small and big blocks based on transaction complexity, eliminating the need for manual configuration.

| Block Type | Transaction Examples |

|---|---|

| Small Blocks | Simple swaps, standard transfers, quick transactions |

| Big Blocks | Adding CL liquidity, complex interactions, large deployments, transactions >2M gas |

The system analyzes transaction size and complexity in real-time, seamlessly switching between block types in the background. When a transaction requires big blocks, the system automatically:

- Disables small blocks

- Executes the transaction on big blocks

- Re-enables small blocks after completion

No more manual toggling just sign your transactions. Enable "Big Blocks Auto-Switch" in your Ramses settings to activate this feature.

Fix big blocks errors

To utilize big blocks, you need:

- A HyperCore user account - Created by having a spot balance on HyperCore

- HYPE on HyperCore - HYPE tokens on Core to pay for the

evmUserModifyaction that enables big blocks

The evmUserModify action that sets usingBigBlocks: true runs on HyperCore, which is why HYPE on the Core account is required. For actual big block transactions on HyperEVM, you'll also need HYPE on EVM for gas fees.

If you're encountering errors with big blocks, follow these steps:

- Navigate to Hyperliquid Portfolio

- Click "EVM <-> Core Transfer"

- Transfer 0.1 HYPE from EVM → Core (needed for

evmUserModifyaction) - Enable Big Blocks or Big Blocks Auto-Switching on UI.

With Ramses' Big Blocks Auto-Switching enabled, you don't need to manually toggle usingBigBlocks. The system handles this automatically based on transaction complexity.