Core concepts

xRAM

What is xRAM?

xRAM is a token developed by the Ramses team to address the sustainability challenge associated with earlier ve(3,3) models. xRAM combines the best of vote-escrow models with the flexibility of traditional escrow incentive systems.

No more lengthy lock-ups to participate fairly.

What can I do with xRAM?

xRAM stakers can vote to direct emissions to their favorite LP pairs and earn 100% of protocol fees and vote incentives. Stake to earn HYPE from buybacks, or mint hyperRAM (liquid staked xRAM) to auto-compound rewards.

Token

xRAM is a non-transferable representation of 1 unit of RAM held in escrow within the xRAM smart contract. Only holders of xRAM have voting rights on Ramses. While xRAM itself is non-transferable, it offers users the ability to exit their position when needed.

How is xRAM obtained?

Users can acquire xRAM through vote incentives, token emissions, or by converting RAM.

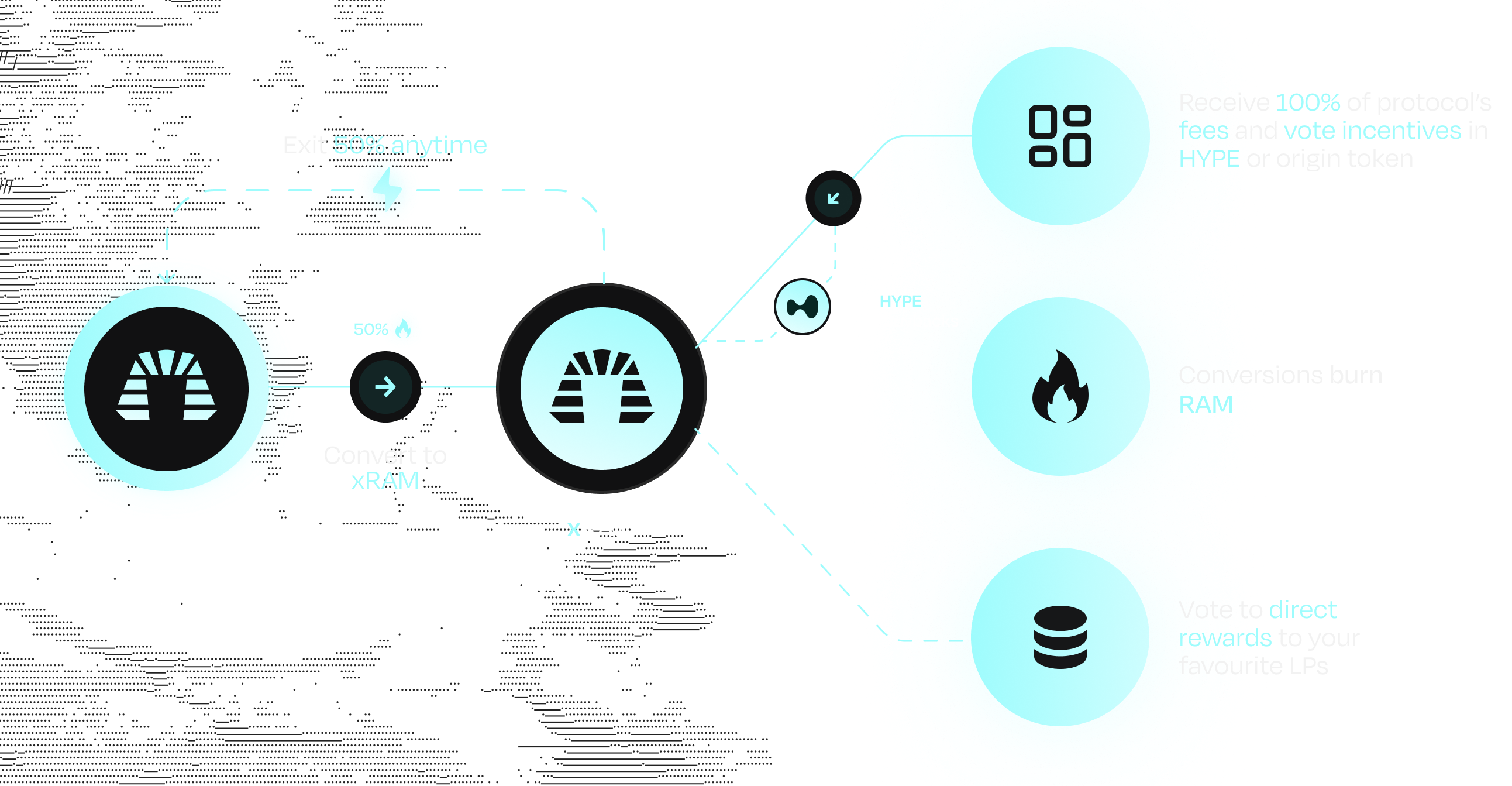

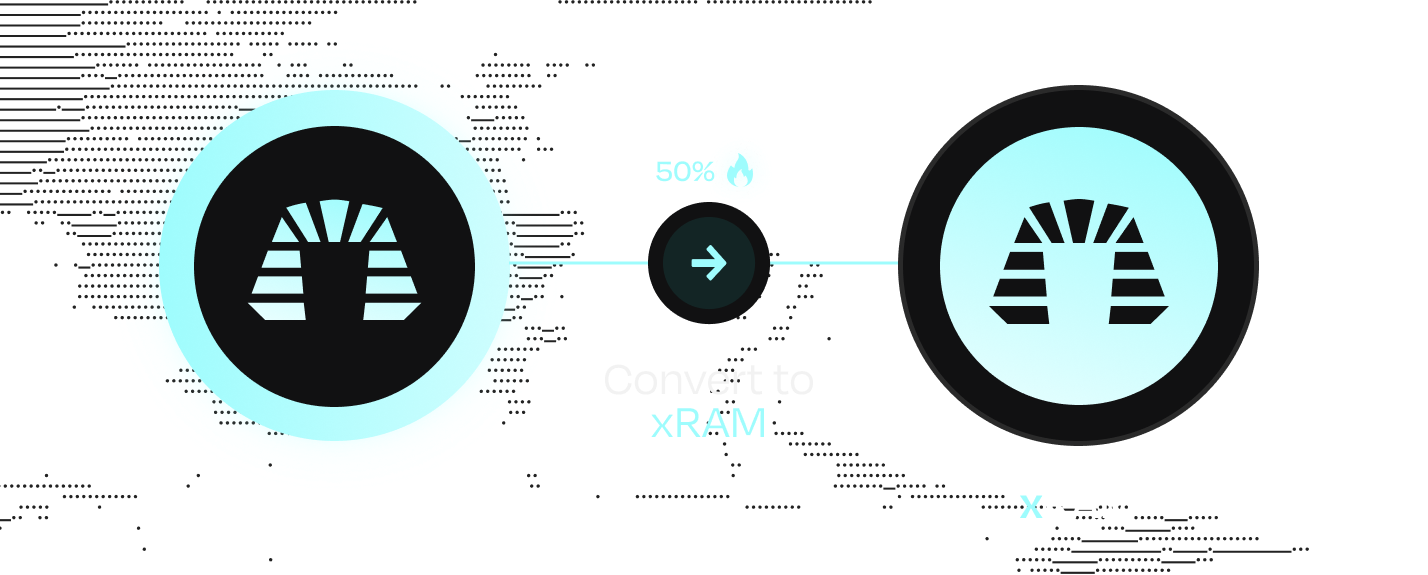

RAM > xRAM conversion

RAM can be freely converted into xRAM at any time. The process is instant, and 50% of the RAM is burned during conversion.

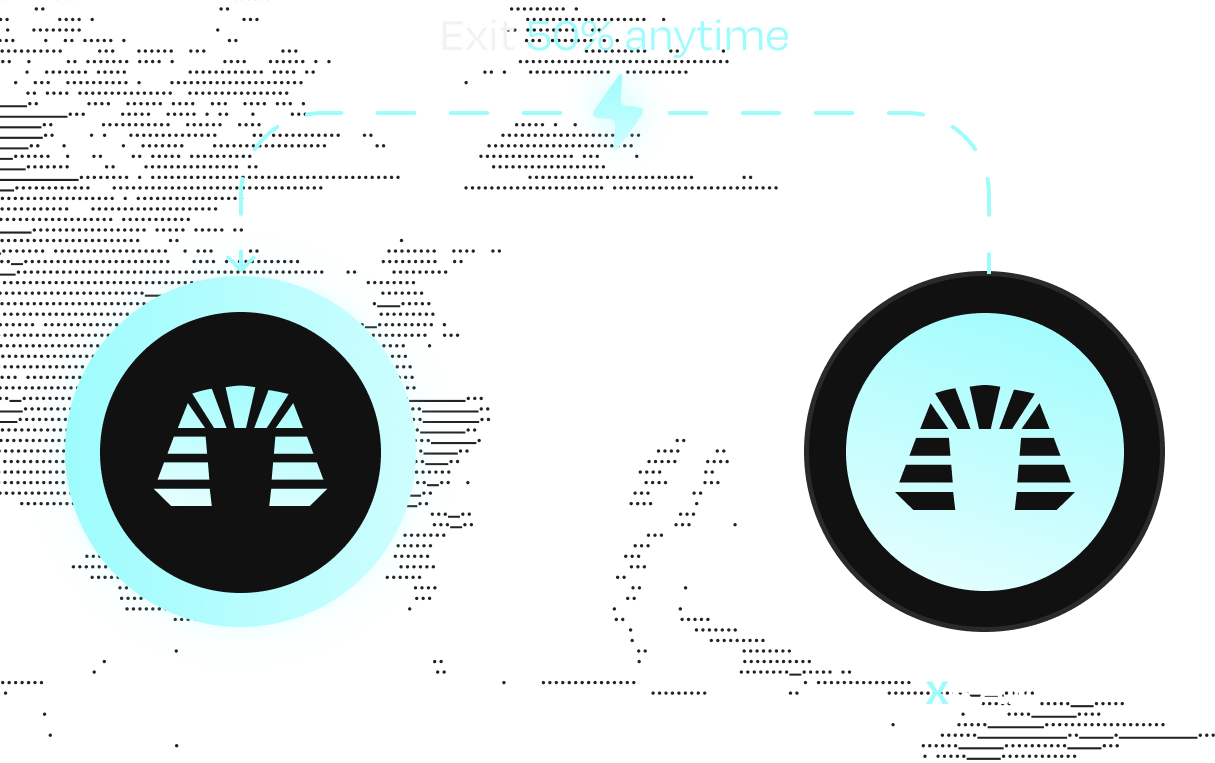

How to exit xRAM?

xRAM > RAM redemption

Users can exit their xRAM position in two ways:

- Direct redemption: Convert xRAM back to RAM instantly for the underlying (1:0.5 ratio)

- Liquidity exit: Use hyperRAM, the liquid staked version of xRAM, to trade your position on the open market

The 50% burn occurs when xRAM is minted, not when exiting.

AutoVaults (Relays)

Users can choose to stake xRAM in AutoVaults to receive rewards in their preferred token instead of manually voting or minting hyperRAM. AutoVaults support multiple reward tokens including ETH, HYPE, USDC, USDT, BTC, and more.

After each epoch flip, protocol revenue from fees and incentives is converted to your selected reward token and distributed automatically.

AutoVaults use the same x33 voting methodology as hyperRAM, running continuously in the background. No manual voting, no maintenance, no decision fatigue. Learn more about AutoVaults →

| Source | Conversion | Distribution |

|---|---|---|

| Fees & Vote incentives | Converted to HYPE via buybacks after epoch flip | Distributed to stakers pro-rata |

Stakers receive HYPE pro‑rata based on stake and participation; unstaked xRAM does not earn rewards. Rewards are available immediately after the weekly epoch flip.

xRAM Liquid Staking

Ramses was designed to eliminate friction from the ve(3,3) model, and managing voting positions is one of the biggest sources of this friction. The liquid staked version of xRAM simplifies this process by automating voting and reward claims without disrupting xRAM's core mechanics.

Before each epoch flip, there is a 1-hour period where liquid staking tokens cannot be minted so votes can be calculated.

hyperRAM

hyperRAM is the liquid staked version of xRAM and can minted with xRAM. The hyperRAM:xRAM ratio starts at 1.00:1.00 and increases in hyperRAM's favor as rewards accrue from fees and vote incentives.

| Feature | Benefit |

|---|---|

| Automated Voting | Voting algorithm for mathematically perfect voting |

| RAM Buybacks | Sells rewards for RAM using aggregators for optimal execution |

| Auto-compounding | All vote incentives and fees increase the hyperRAM:xRAM ratio |

| Zero Fees | No costs for deposits, withdrawals, or compounding |

| Full Liquidity | Trade freely on open market unlike staked xRAM positions |

| Price Protection | Cannot trade below xRAM redemption value (instant exit) |

| hyperRAM.ratio() ⬆️ | hyperRAM:xRAM ratio always increases from rewards |

After every weekly epoch flip rewards from fees and vote incentives are automatically sold to increase the hyperRAM:xRAM ratio. Below is an example showing how hyperRAM:xRAM ratio will increase over time.

Does not bypass exit fee

While hyperRAM offers instant liquidity, it doesn't circumvent xRAM's exit penalty. As the liquid staked version of xRAM, hyperRAM's market price naturally reflects the instant exit fee structure. The token cannot trade below the xRAM redemption value because arbitrageurs would immediately buy and redeem hyperRAM for xRAM to capture the difference. While hyperRAM cannot trade below the xRAM redemption value, it may trade at a premium to this based on market dynamics.

After each epoch flip while rewards are being sold and compounded, there is a 24-hour TWAP buyback period during which new hyperRAM cannot be minted from xRAM. Withdrawals are not affected, you can still withdraw your xRAM during this period.

Exit Burn

Ramses incorporates a burn mechanism that provides dilution protection for xRAM holders and permanently reduces circulating supply when xRAM is minted. This mechanism is deflationary and does not distribute burned tokens to users.

Burns occur during the conversion process, protecting remaining holders through lower circulating supply over time.

Why?

As discussed in the ve(3,3) section, ve(3,3) introduced important improvements to user alignment but still had fundamental limitations. xRAM builds on these improvements while addressing the core issues, moving the power balance back towards users. Instead:

- Stakers who remain in xRAM longer earn more fees and vote incentives.

- Users can exit their position at any time, ensuring rewards flow to those who value it the most.

Exit penalties create a "survival of the fittest" ecosystem where less committed capital is burned during conversion and active stakers earn increased rewards through deflationary economics. Any size can exit, unlike liquid wrappers (limited liquidity) or veNFTs that are large to sell (pseudo-liquid). This deflationary mechanism makes Ramses the first deflationary ve(3,3) protocol, where each exit contributes to the value of remaining tokens.

Voting

xRAM holders are rewarded for actively participating and voting—earning 100% of protocol fees and vote incentives. When you vote for liquidity with gauges, you receive a proportionate share of all fees generated by that liquidity, plus any additional vote incentives offered by protocols to attract emissions.

| Trading Fees | Vote Incentives |

|---|---|

| 100% of trading fees on liquidity you vote for | Additional rewards offered by protocols to attract votes to their pairs |

- Both fees and vote incentives are claimable immediately after Epoch flip.

- Vote incentives can be in any whitelisted token, learn more.

Voting Breakdown

The main purpose of the xRAM token is to vote to direct emissions to liquidity. This is achieved through weekly voting for gauged liquidity. Emissions are distributed proportionally to the total percentage of votes in the Epoch.

Emission Calculation

The expected emissions can be calculated using a simple division formula:

For example, 100,000 RAM is distributed in a single epoch. If 10% of all votes are allocated to the RAM / USDC pair, that pair will receive 10,000 RAM tokens distributed linearly to liquidity providers of the relevant LP pair throughout the epoch.

Vote Weight Calculation

The voting power of xRAM is determined by:

- Amount of xRAM held

- Active participation in voting

- Epochs reset every Thursday at 00:00 UTC

- Votes determine emission distribution for the following week

- Emissions are distributed linearly throughout the epoch