Core concepts

Ramses X

From Governance DEX to DeFi Infrastructure

Ramses has matured beyond a single-chain, governance-heavy DEX. Ramses X represents the next phase: automation, fee-first deployments, and a multichain architecture designed to scale without fragmenting liquidity or incentives.

Less effort. More rewards.

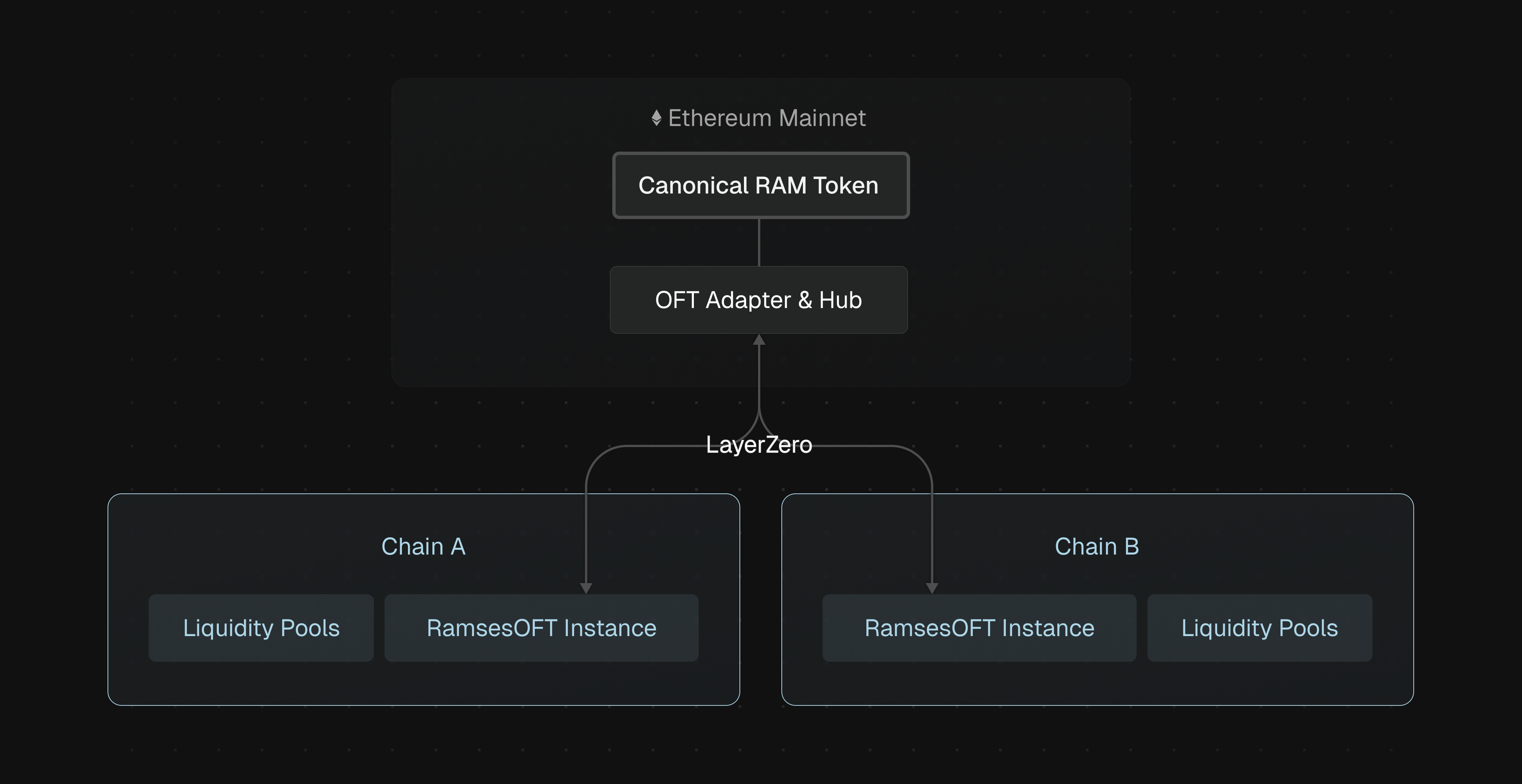

Architecture Overview

Ramses X is structured around three core components: canonical RAM, chain-specific execution, and a shared deflationary sink.

RAM Token & OFT Connectivity

RAM exists natively on Ethereum Mainnet.

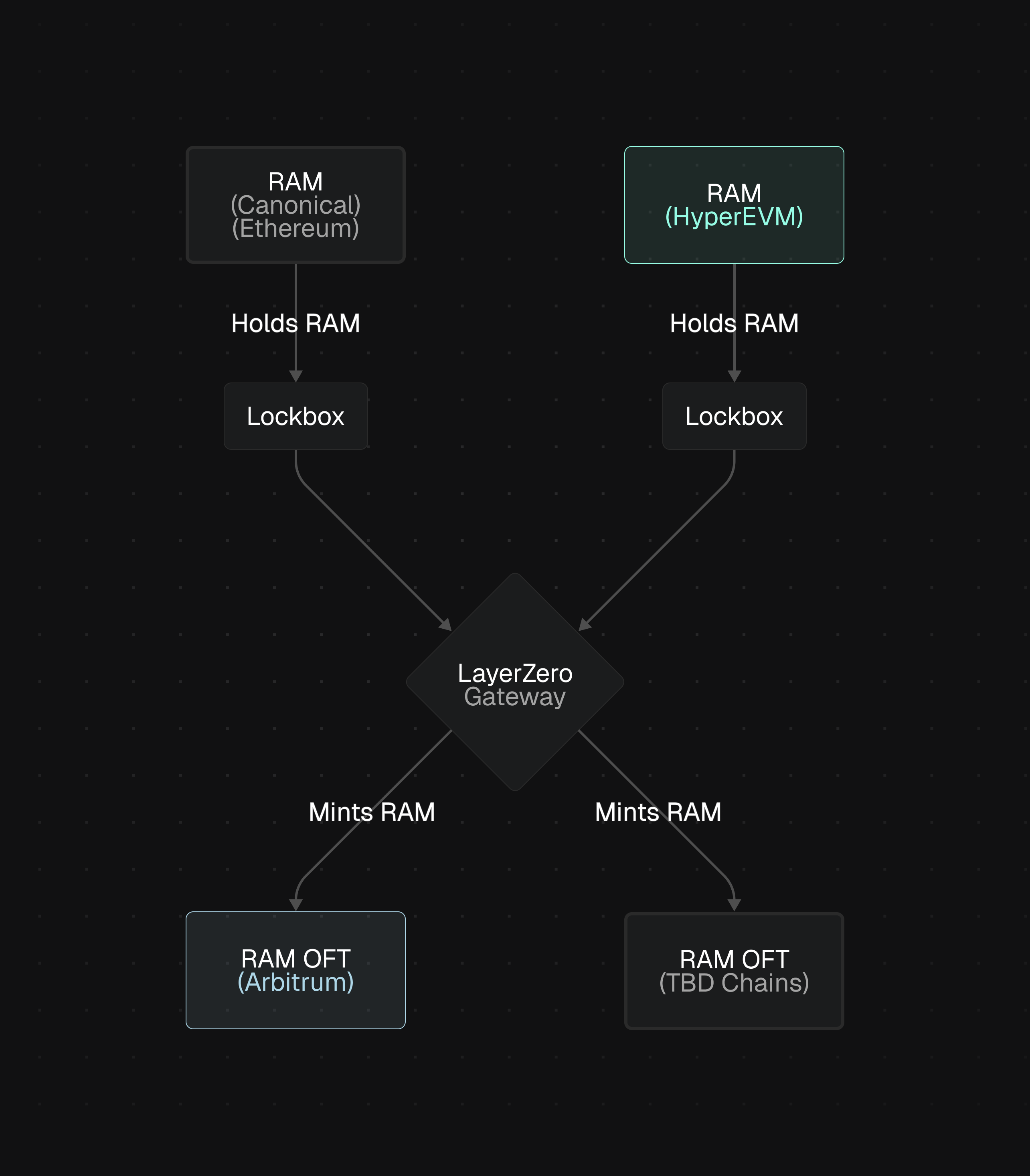

An OFT (Omnichain Fungible Token) adapter and hub coordinate RAM supply across all supported chains. Each deployment runs a RamsesOFT instance, but all are anchored to the same canonical RAM supply on Ethereum.

| Component | Function |

|---|---|

| Canonical RAM | Native token on Ethereum, single source of truth for total supply |

| OFT Adapter | Bridges RAM to other chains via LayerZero with feeless transfers |

| Lockbox | Holds RAM on origin chains while OFT instances mint on destination |

| RamsesOFT | Chain-specific RAM representation, fully backed by locked canonical RAM |

This allows Ramses to expand across ecosystems without:

- Duplicating tokens

- Splitting liquidity

- Weakening governance alignment

RAM remains singular, portable, and consistent everywhere.

Chain Structure & Fee Handling

New chain deployments begin with governance inactive.

Phase 1: Fee-Only Mode

In this initial phase:

| Feature | Status |

|---|---|

| Liquidity earnings | Swap fees only |

| Protocol share | Used to burn RAM |

| Emissions | Inactive |

| Gauges & Voting | Inactive |

This creates immediate deflationary pressure tied directly to usage. No emissions are distributed until the chain proves organic demand.

Phase 2: Governance Activation

Once a deployment reaches predefined performance and consistency thresholds, governance can be enabled.

At that point:

| Feature | Status |

|---|---|

| Fee logic | Expands to include RAM emissions |

| Voters | Earn fees plus incentives |

| Revenue stream | Backed by real activity |

This model enforces discipline. Demand is proven first, incentives come second.

Specific parameters including governance activation thresholds will be published alongside each chain deployment.

What This Enables

| Outcome | Benefit |

|---|---|

| Single Canonical Asset | RAM remains unified on Ethereum, no fragmented tokens |

| Independent Scaling | Chains scale on their own, starting fee-only |

| Earned Governance | Governance is activated after proving demand |

| Value Accrual | Fees either reward LPs or burn RAM |

| Automation | AutoVaults replace manual voting participation |

| Default Value Flow | Value accrues to token holders by default |

Ramses evolves from a governance-centric DEX into modular DeFi infrastructure.

Supported Chains

| Chain | Status | Governance |

|---|---|---|

| Ethereum | Canonical RAM | Native |

| HyperEVM | Live | Active |

| Additional Chains | Coming Soon | TBD |

Specific launch timelines, supported chains, and governance thresholds will be finalized and published alongside their respective deployments.